TOKYO, Feb 22 (Reuters) - Japan's efforts to rebuild its semiconductor industry are getting a shot in the arm as more and more Taiwanese chip companies expand here - not only to support a new TSMC (2330.TW), opens new tab plant but also excited about the Japanese sector's prospects.

The influx comes amid shifting alliances and priorities in the global chip industry as the United States pushes to limit China's progress in cutting-edge semiconductors and strengthen partnerships between its allies.

Fabless chipmaker Alchip Technologies (3661.TW), opens new tab, which specialises in customised chips known as application-specific integrated chips (ASICs), is illustrative of the China decoupling trend.

In 2022, the bulk of its research and development engineers were based in China but Alchip has begun moving roles overseas, many to Japan, said a source who was briefed on the matter.

The company said it is hiring in Japan, North America and Taiwan but declined to comment further on personnel matters.

"We're expecting Japan semiconductor market growth, we're continuously capitalising on Japan ASIC opportunities and already engaging in several good projects," said Hiroyuki Furuzono, general manager of Alchip Japan.

At least nine Taiwanese chip firms have set up shop or expanded operations in Japan over the past two years, according to a Reuters count.

Chip design company eMemory Technology (3529.TWO), opens new tab, for example, opened an office two years ago in Yokohama, which neighbours Tokyo, and has 11 employees after hiring from Japan conglomerates which once dominated the industry.

"After we built the office there we are receiving more frequent communication with the customers and they are more willing to talk in Japanese with our local people, so we see business is booming," eMemory President Michael Ho told Reuters.

More Taiwanese chip sector firms are also looking at increasing their presence or making their first foray into Japan, said the source and another person with knowledge of the matter, adding that a weak yen has made such decisions easier.

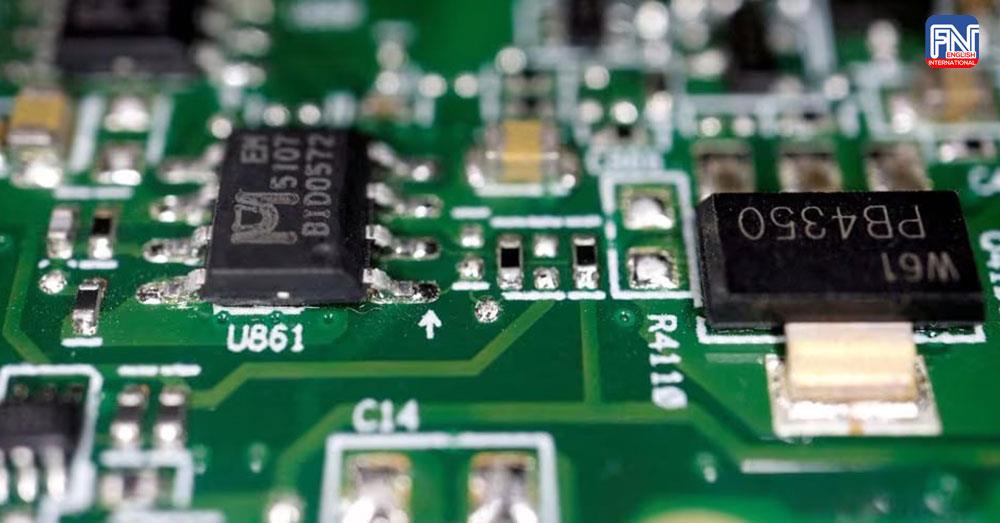

Photo from Reuters